As the dust settles on another Christmas, many of us are left wondering where to store the gifts we received, some of which we will likely never use again. When it comes to investment decisions, you would hope these choices are made with more thought than buying a smart water bottle or bread maker. Unfortunately, this doesn’t always seem to be the case!

A study by the FCA found that 66% of 18-40-year-olds spend less than 24 hours deciding on an investment, with 14% making their decision in under an hour. Additionally, a quarter of those surveyed make investment decisions impulsively just to keep up with current trends. (1)

I can understand the exuberance of youth. I remember several years ago when a colleague claimed a certain stock, valued at £0.40, would reach £2.00 within months. They believed this because they were told the company was close to a major discovery. My desire to make a quick profit overrode the logic that it was unlikely a 24-year-old from Bolton had insider information from a Scandinavian mining company. Needless to say, the shares tumbled, and 14 years later, they are still worth 52% less than what I paid for them.

What if my experience was just an unfortunate case of following the crowd, which affected my decision-making? Think back to Covid, when everyone’s behaviour had to change—working from home, exercising differently—which led to rapid growth for some companies as we adapted, and demand increased for certain sectors. In the moment, it’s hard to step back and realise that our habits can revert just as quickly as they changed as can the popularity of buying certain shares.

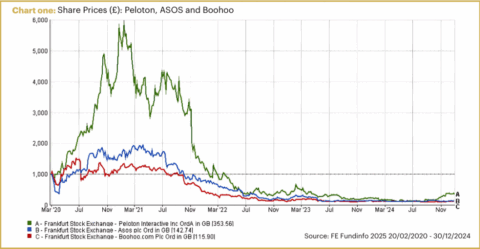

A prime example is Peloton, whose share price increased by 467% in nine months starting from March 1, 2020. However, if you had invested £1,000 in the preceding two years, by the end of 2024, your investment would be worth at best £601 and at worst a mere £393! Asos and Boohoo have faced similar fates over the last five years as societal attitudes change.

Another interesting finding in the study was that 40% of 18-40-year-olds regretted investing in hyped investment products. Avoiding hype and knowing what you are getting into can help you decide if an investment opportunity is right for you.

At Equilibrium, we pride ourselves on being evidence-based investors. We focus on the fundamentals and drown out the noise to make informed decisions. Our Financial Planners and Investment Team are always available to chat with younger family members and steer them away from rash choices. This way, investment decisions are more successful—think of it like getting a practical gift for Christmas that’s useful now and in the future, like an air fryer, instead of a novelty item like a flashy Bluetooth toaster!

If you want help yourself or loved ones avoid making rash investment decisions, please get in touch as we are here to help. Clients can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact.

If you are new to Equilibrium and would like to speak with one of our experts, contact us here or on 0161 383 3335 for a free, no-obligation initial chat.

This blog is intended as an information piece and does not constitute a solicitation of investment advice.

Sources

1 – www.fca.org.uk

Mark Barlow

Mark Barlow