The arrival and adoption of Artificial Intelligence (AI) within the financial planning profession has sparked considerable interest and debate, largely around further advances in technology and its potential to shape the future.

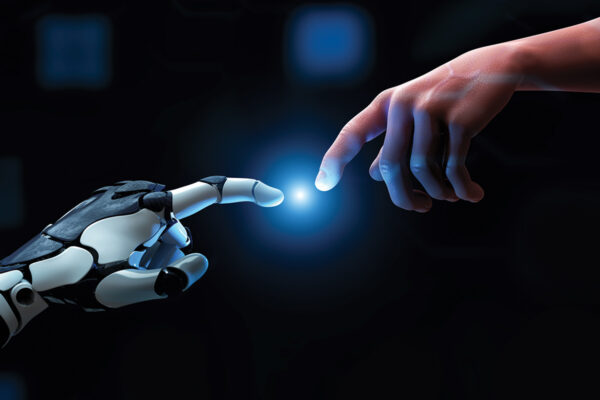

We already know AI can deliver on certain tasks, taking away work, but what about its potential to take away jobs – could it ever replace human financial advisers? We believe that AI can leverage financial planning in many ways, however, one aspect it cannot replace is the relationship between an adviser and their client.

Managing our money is personal and emotive, as financial planning is intrinsically linked to a deep understanding of our goals, aspirations and fears. Fundamental to this is the human ability to listen, understand and capture the nuance of these highly personal interactions.

The technical aspects of financial planning can be intricate, creating plans and strategies that are delivered over lifetimes. Navigating life events and the delicate discussions that these can present is highly intricate too, requiring empathy and high levels of emotional, not artificial, intelligence.

The ability to build and maintain trust is critical in financial planning. As in the phrase: “People do business with people they know, like and trust”, it will be a long time, if ever, before AI can build long-term relationships that replicate the level of reassurance provided by a known, trusted human adviser.

The above highlights the strengths and emotional intelligence of human advisers, however, we must also consider the complementary sets of strengths that AI brings to the table and how these can add real value to businesses and clients.

We are at the early stages of our relationship with AI, having recently introduced Saturn technology to reduce administration during meetings, shifting our focus to areas where we can create more impact and better outcomes for our clients.

Firstly, AI excels in efficiency and automation. AI can rapidly process vast amounts of data, identifying patterns, and automating repetitive tasks. Saturn is efficient, joining meetings and quickly capturing thorough notes of conversations, learning as it listens. Once the meeting ends, Saturn’s technology produces a detailed summary of the key facts and discussions, a task that would take a human significantly longer to produce. No longer typing up reams of handwritten notes, the output from Saturn is reviewed and refined by the client manager, repurposing time for those tasks that need the human touch, expertise and experience.

Another area is cost-effectiveness, AI-driven tools represent a cost-effective alternative for clients with simpler financial needs, adeptly managing investment portfolios tailored to individual risk tolerances and goals.

Finally, AI brings a level of consistency that can be challenging for human beings to match. Saturn brings the same methodology to every meeting, regardless of the time of day or its “workload”. It doesn’t have good or bad days, get fatigued and need a holiday. This ensures emotional consistency, reducing the risk of human error and misunderstandings we can all make through oversight or cognitive biases.

The continued integration of AI in financial planning presents both challenges and opportunities, as the ‘how’ work gets done and ‘by whom’ continues to evolve.

We believe that AI and technology’s greatest impact will be in complementing and enhancing human capabilities, not replacing them. What can feel easy for a person, like asking an insightful question, can be challenging for AI. Equally, tasks that are simple for machines can be nearly impossible for humans.

The future of work is about working together, smarter through “collaborative intelligence”. This is when humans and artificial intelligence come together as teammates, actively complementing each other’s strengths in pursuit of the same outcomes in the most effective ways. This is what we have sought to do with the introduction of Saturn, and we are curious about how else we can work with AI to play to its and our strengths in the future to further enhance our service.

Financial planning has many human elements – connection, empathy and understanding which remain at its very core. By embracing and integrating only the right AI tools, businesses and individuals can enhance their skill sets for the future, excelling by offering high-value experiences that AI alone cannot provide.

While machines can handle some aspects of financial planning, what we do and how we go about making people’s lives better will always need the touch of the human heart.

This article was featured in the autumn 2024 edition of our financial planning and investment magazine, Equinox. To download your free copy, click here.

If you have any further questions, please don’t hesitate to contact us. Clients can reach us on 0161 486 2250 or by getting in touch with your usual Equilibrium contact.

If you are new to Equilibrium and would like to speak with one of our experts, contact us here or call us on 0161 383 3335 for a free, no-obligation initial chat.