Financial planning

We take a personalised approach to financial planning, aligning strategies with your goals and circumstances. Whether you're planning for retirement or just starting out, our expert guidance ensures clarity and confidence. For simpler needs, our Essentials service offers streamlined support. Learn more in our Retail Client Agreement.

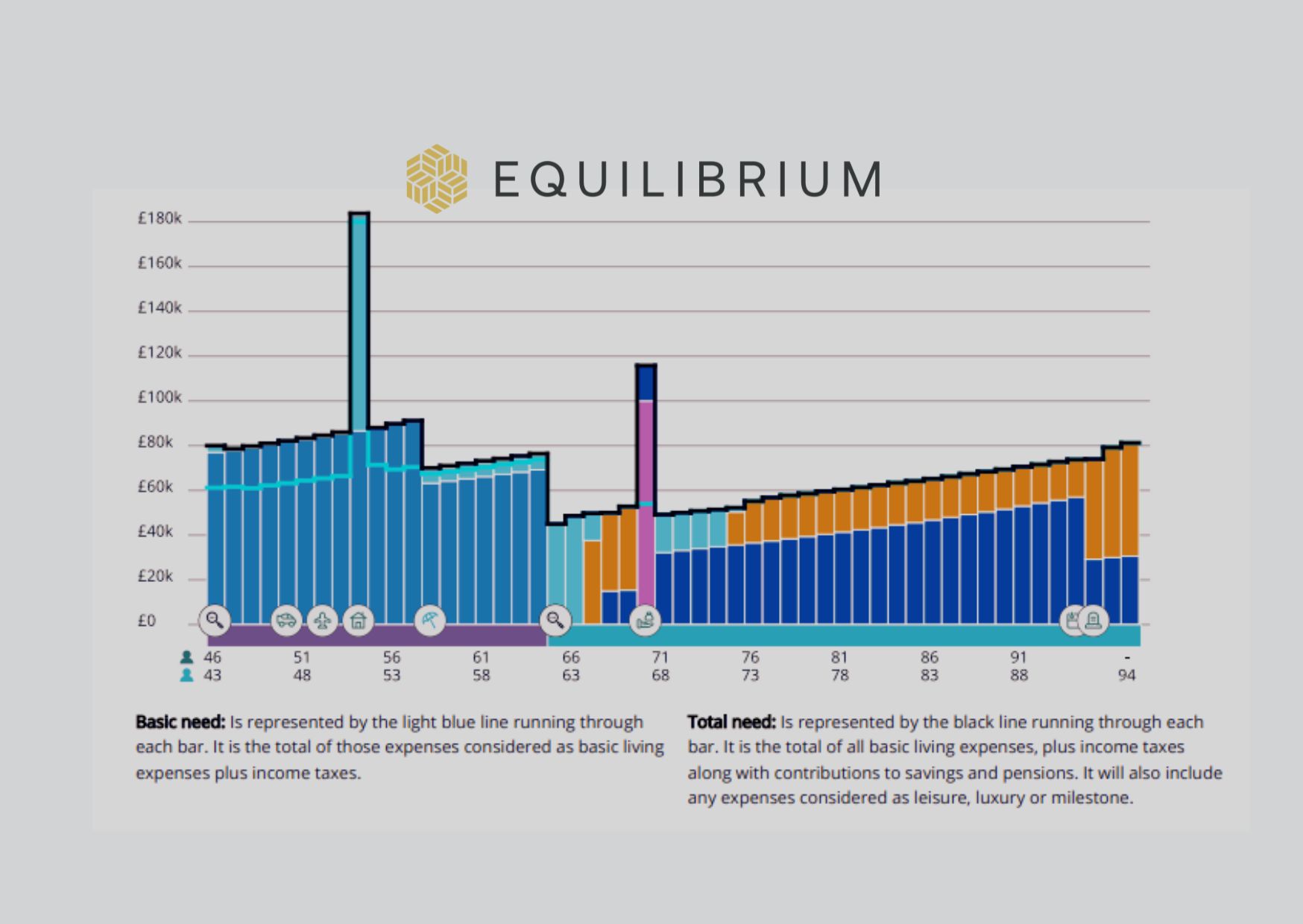

Cash flow forecasting

Cash flow forecasting is central to our financial planning. Using dynamic modelling, we project income, expenses, assets, and liabilities to create a personalised roadmap. Whether planning for retirement, education, or gifting, our forecasts support informed decisions. Regular reviews ensure your plan adapts to inflation, investment growth, and lifestyle changes.

Retirement planning

We guide you through pensions, savings, investments, and tax planning with clarity and care. Our flexible strategies adapt as life evolves, helping you move from uncertainty to confidence. Whether you're planning for retirement or future goals, we ensure your financial journey is secure, empowering you to retire on your terms.

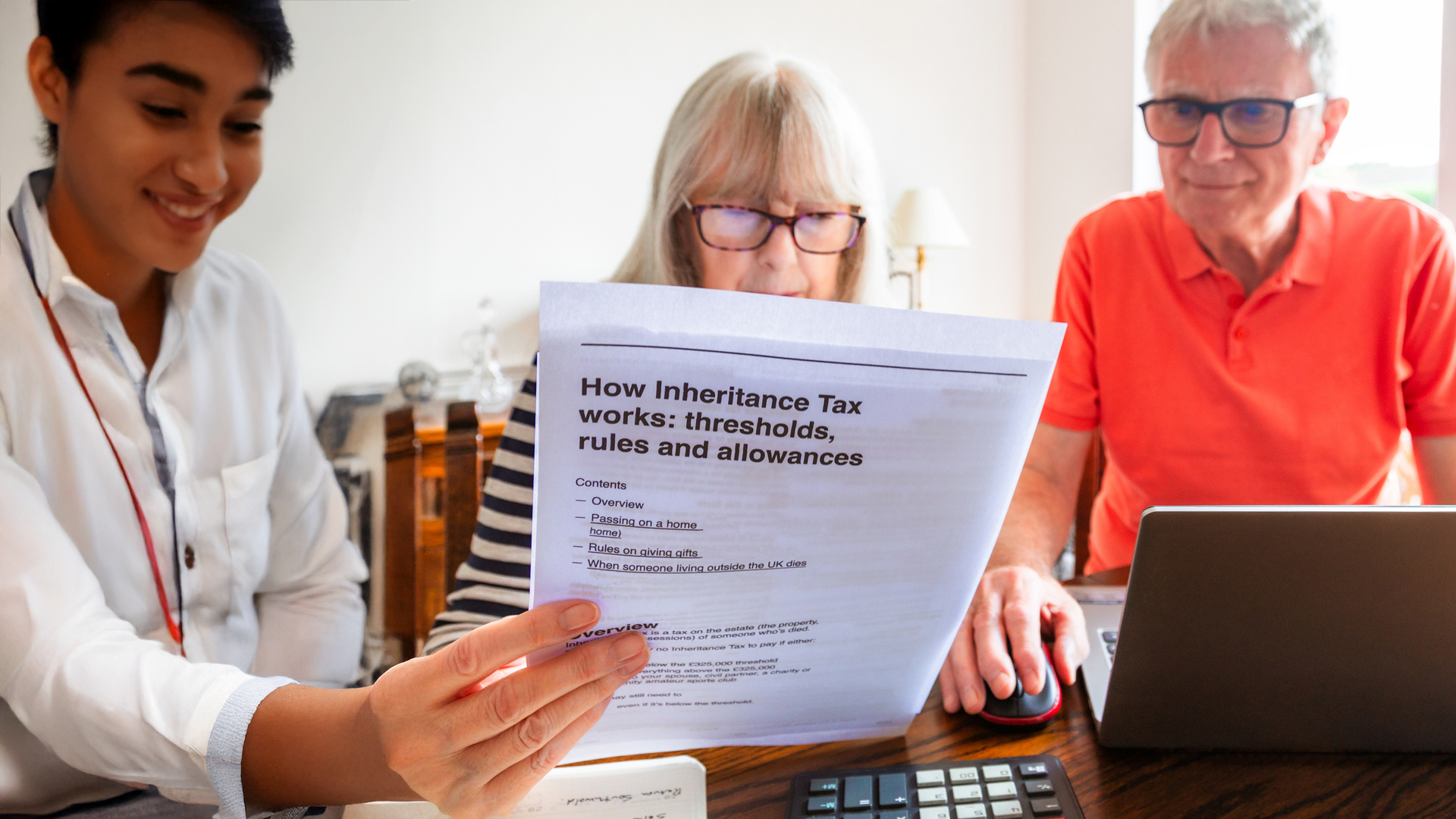

Inheritance tax planning

With frozen thresholds and rising asset values, more families are unexpectedly impacted by IHT. We take an intergenerational approach to help you pass on wealth efficiently and ethically. Whether planning for loved ones or charitable giving, we guide informed decisions that protect your legacy and reflect your values.

Investment management

We focus on real returns, inflation-beating performance, and smart asset allocation, supported by strong diversification. As active owners, we engage with fund managers and companies to promote responsible investment practices. This approach helps you invest with confidence, knowing your portfolio is built with purpose and long-term resilience in mind.

Tax mitigation

Our expert team helps you navigate income tax, capital gains, and inheritance tax with tailored strategies. From using allowances to structuring investments and wealth transfers, we ensure your plan is tax-efficient. This gives you greater freedom to live well, support loved ones, and leave a meaningful legacy.